Programming Note: Starting from this post, we will be moving to Sundays at 9:30 AM CST

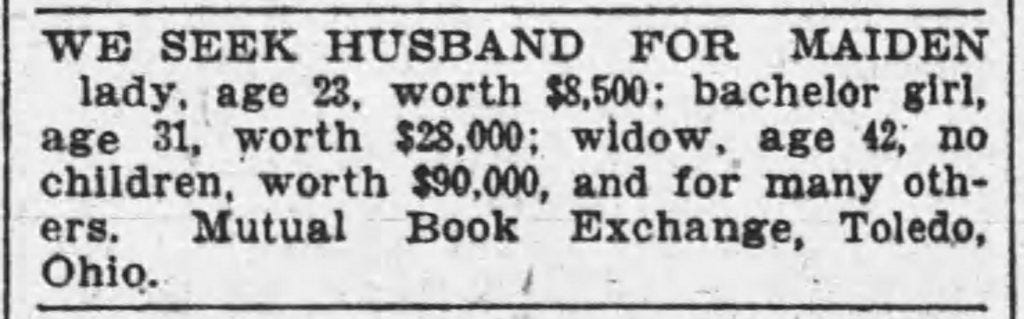

SEEKING HUSBAND FOR MAIDEN, COMPANIONSHIP FOR WIDOWER, WEALTHY YOUNG MAN LOOKING FOR TRUE LOVE.

Lonely Hearts Ads - The dating app before there were dating apps. Since the 1600s, eligible individuals seeking companionship used to place matrimonial ads in their local newspapers. You’ve probably heard the rhetoric, but here are a few examples.

Eventually, newspaper ads became dated when the telegram revolutionized real-time communication. Phone dating took form, and people could leave their numbers on a dedicated line for others to find. Paid services offered the opportunity to hear messages from people looking for someone. Usually, you could take their numbers (which they left on these lines) and call them to initiate a conversation.

Then, the early days of the internet evolved phone dating into chat rooms offered by the early internet giants like AOL. Classifieds previously in newspapers evolved into classifieds on Craigslist. Remember Craigslist Personals? People could post that they’re looking for companionship and just like you’d reach out to someone selling their used PlayStation, you could connect with a future partner.

Personals shut down in 2018, signaling an end to centuries of dating without a third party involved.

Matchmaking and dating services existed in vacuums and local markets, but scalability was never a factor until Silicon Valley came into town. Gary Kremen, a Stanford Business School graduate, noticed the piles of cash local newspapers made from personal ads and sought the opportunity to do the same on the internet.

In 1995, Gary launched Match.com, an online dating site where people could exchange personal messages and photographs through email. The growth was insane. Within months, 100,000 users signed up for the service. By 2010, the platform grew to over 1.5 million subscribers and spread to over 30 countries. End of story, right?

Churn

With users comes churn. Ever heard of BeReal? The social media company that had grown to 53 million users in 9 months over 2022 has seen a 61% drop in daily active users. 15 million DAUs quickly became 6 million. Churn was a massive issue, with rates as high as 20.7%.

If you’re running a subscription service like Uber One, Netflix, or hell - even a Utility company, your customers generally sign up, use your product for a while, and typically never leave if they are satisfied. Take Netflix, which arguably has the best churn rate in the business at around 2% monthly.

Tinder, Hinge, Bumble, and practically every other dating app deal with an added issue.

People trickle in and fill the platform, swiping every which way and making matches with each other. Eventually, some find love, and others drop out and give up. Whether you find success or not, you end up churning out of the platform!

What do churn rates look like for dating apps? Generally, 20% monthly! Annualized, that is around 90% of your entire user base churning out each year.

If you have a 70% annual churn rate, you have to have a strategy to replace almost your entire customer base each year, plus a bunch of percentage points to drive topline growth.

- Andrew Chen, GP at Andressen Horowitz

Imagine you’re a founder of a dating app you have to coax an investment from Andrew at a16z. How do you explain near-hundred percent rates of churn to your investors? What is your sustainable competitive advantage versus a competitor?

The good thing is that churn can be positive. Positive churn is when a customer enters the app, has a great experience, finds a match, and ultimately leaves the platform because it worked out. Yes they churn, but while they use the platform they are super engaged, spend a boatload of time and money, and let the app consume all their attention.

When your experience is great, your partner’s is too. That’s two people who are both spreading the word about the platform.

Consolidation

Positive churn sounds like a great rainbow wonderland explanation for your investors. That coupled with statistics that 1 in 5 American adults have used online dating services paints a good picture about top-line growth and word-of-mouth success.

However, the reality is that your app’s experience is essentially the same as the next one out there. Platforms are already hyper-optimized. Hyper-gamification with swipe surges and user retention tactics through push notifications and external messaging.

I open them just because a push notification has informed me that I have new recommended matches, or because “swipe surge is now in session”; soon the smooth-flowing interface is inviting me to peruse and “like” profiles.

These apps do have differences in the markets they cater to. Grindr, Farmers Only, Muzz, Dil Mil and others choose smaller pockets to emphasize. Past that, these apps are commodities. Once a market becomes commoditized, customer acquisition costs skyrocket and lifetime values get put in jeopardy.

Apps also lack stickiness. More than 30% of people between 18 and 44 claim to use multiple dating apps at a time.

All of this brings us to consolidation. Remember the hyper-growth story about Match.com and Gary? Today, the company controls almost the entire dating ecosystem. Tinder, Hinge, Plenty of Fish, and other smaller apps all fall under the holding company’s reach. 50% of relationships that start on an online dating site are owned by Match Holdings.

So when that investor asks you how your app is going to succeed - here’s your pitch. We’re going to grow our user base to a critical mass, hitting organic growth points and great CACs. Once we have a critical mass, we’re hunting for an acquisition. Sell our platform, the users we have, and the data we gathered for a 10x on your investment.

That’s all for this one folks! If you enjoyed this piece on the dating app ecosystem, hit the like button or drop a comment with your take. Reach out to us by replying to this email if you have any insider takes or leave a comment on our Substack page!